The latest house price figures from the UK House Price Index were released this week providing a comprehensive look at the state of the UK market.

The index is based on sales completion data and provides the clearest view of how the property market is performing, but due to the process of collecting this data it is reported on a lag and so the most current data is for August 2018.

Despite August traditionally being a slower month due to many putting their sale or purchase on the back-burner while they go on holiday, the top line stats make for welcome reading with house prices up 0.2% over the month and 3.2% compared to this time last year.

But while the market is holding its own, there are still some clear signals that continued political uncertainty caused by Brexit is still restricting activity.

While prices are still up year on year, the rate of growth has eased from 3.4% in August 2017 to the 3.2% recorded this year. The RICS also recorded a five-month low in the number of newly agreed sales, with mortgage approvals also down and property transaction figures showing a reduction in transactions of 2.6% year on year.

However, transactions did see an uplift of 1.3% on a monthly basis, which could indicate that sellers are starting to adjust their expectations to see their sale over the line.

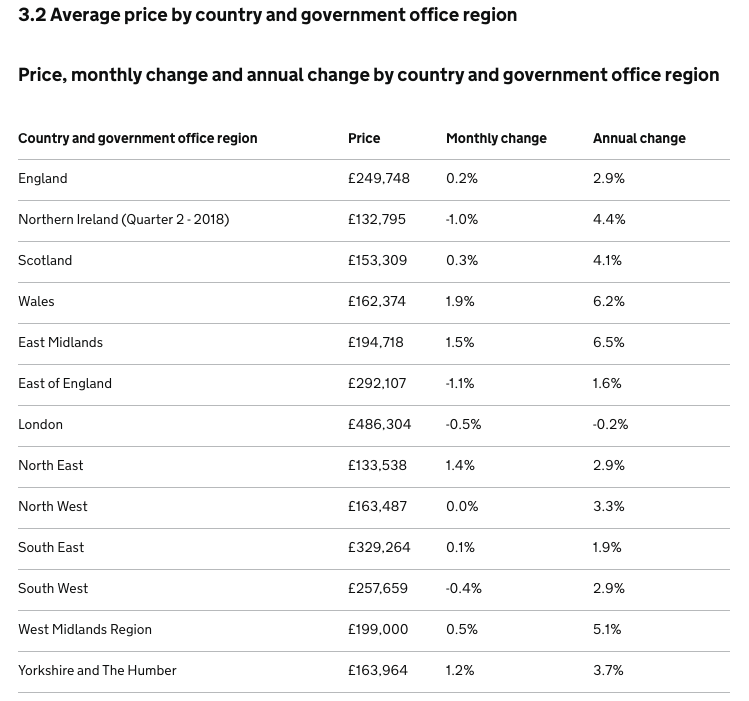

It’s also clear that while the top line figures show an air of lethargy, the diverse regionalities of the UK market tell a different story.

London continues to struggle with prices down -0.5% monthly and -0.2% annually, but homeowners in the East Midlands have seen an impressive annual increase of 6.5%.

Wales has also seen strong annual growth at 6.2%, with the West Midlands, Scotland and Northern Ireland also registering growth above 4% over the last year.

Wales has also seen strong annual growth at 6.2%, with the West Midlands, Scotland and Northern Ireland also registering growth above 4% over the last year.

So there are areas of the UK market that seem more resistant to the current landscape than others but as our Business Growth Expert and CEO Andy Soloman explains, current market conditions echo wider economic issues where a hesitance amongst consumer decision making is having an impact.

“While positive growth both annually and monthly is a silver lining at least, a further slow in the annual rate of growth is consistent with the wider economic picture.

Much like other sectors where we’re seeing consumers hold back on unnecessary purchases, a notable reduction in the level of property transactions across the UK is an indicator that the wait and see mentality remains prevalent on both sides of the buyer-seller coin.

While this attitude remains, the market will no doubt continue to stutter along, but all things considered, there’s still life in the old dog yet.”

CEO of Yomdel.com - Andy Soloman